So with several pushes for devaluation and depreciation of the Malawi Kwacha, I recalled there is a way of assessing the exchange rate if a currency is over-valued or under-valued against another. So I did some research yesterday and came up with a script to help me with the assessment.

The Real Exchange Rate(Ereal) is the ratio of the Nominal Exchange Rate(Enominal) to the PPP Exchange Rate(Eppp). The following conditions are expected:

- When the Real Exchange Rate is equal to one, the currency is neither over-valued nor under-valued.

- When the Real Exchange Rate is less than one, the domestic currency is over-valued in relation to the foreign currency.

- When the Real Exchange Rate is greater than one, the domestic currency is undervalued in relation to the foreign currency.

So we will have to define each of the two exchange rates Enominal and Eppp.

- Enominal = Cdomestic/Cforeign, where Cdomestic is the domestic currency value and Cforeign is the foreign currency value.

- Eppp = Pdomestic/Pforeign, where Pdomestic is the Domestic Price of a Commodity, and Pforeign is the Foreign Price of the same Commodity.

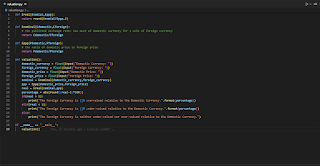

The source code is as follows:

I have published the source code on https://github.com/kondwa/valuation

Let's have some examples:

- So let's assume that the dollar is our domestic currency and the euro is our foreign currency with the nominal exchange rate(Enominal) = $1.18/€1. a Big Mac costs $5.30 in the US and perhaps €4.50 in Europe. The script is able to evaluate that "The Foreign Currency is neither under-valued nor over-valued relative to the Domestic Currency."

- Suppose instead of €4.50, the Big Mac is selling at €5.40 due to inflation while the nominal exchange rate is the same. The script evaluates that "The Foreign Currency is 20% overvalued relative to the Domestic Currency."

- Let's compare the Chinese Yuan and the US Dollar: One US Dollar buys ¥6.8. A Big Mac costs $5.30 in the US, and costs ¥20 in China. The script evaluates that "The Foreign Currency is 45% under-valued relative to the Domestic Currency."

It seems the script is in conformity with the IMF example on the Real Exchange Rate.

We can now try and apply it to the Malawi Kwacha relative to the Dollar:

Yesterday(15th August 2022), the nominal exchange rate was K1,020.00 to $1 and the price of Gold in Malawi was K41,000, while it was $58 in the USA. We evaluate the Real Exchange rate as follows:

Domestic Currency: 1020Foreign Currency: 1Domestic Price: 41000Foreign Price: 58

This gives an evaluation that "The Foreign Currency is 44% overvalued relative to the Domestic Currency."